For Pre-Retirees Who Feel Behind & Are Terrified of Running Out of Money

Rescue Your Retirement: 12 Proven Strategies to Secure Your Future in 24 Months

Without gambling your life savings on risky investments, trusting commission-hungry financial advisors, or becoming a market expert overnight.

"I stopped avoiding my finances — and finally feel like I have a plan."

“I was 57 and scared to even look at my retirement numbers. This guide helped me face it without shame and actually gave me steps I could take right away. I’m saving more than I thought possible and sleeping better at night.”– Linda J.

FEATURED IN

MOST PRE-RETIREES ARE TERRIFIED OF RUNNING OUT OF MONEY

No More Sleepless Nights Wondering If Your Savings Will Last

I get it — you're not alone. I’ve been where you are, and I know exactly what it feels like to:

Obsess over your bank account, wondering if every purchase is draining your future security...

Feel embarrassed that you're behind on savings — especially when it seems like everyone else is retiring comfortably...

Worry that rising healthcare costs, inflation, or a market dip could erase what little you’ve saved...

Lie awake at night fearing you'll become a burden to your children, or worse — be forced to go back to work in your 70s…

🔹 67% of Americans fear outliving their money more than death.

🔹 Nearly 50% of households nearing retirement have no savings.

🔹 The average couple will need $315,000 for healthcare alone.

(Sources: Northwestern Mutual, NIRS, Fidelity)

FINALLY — A PLAN THAT ACTUALLY WORKS

There’s a Smarter, Simpler Way to Secure the Retirement You Deserve

And it’s not obsessing over the stock market, working longer than you planned, or handing your money to another commission-hungry advisor…

The old way of “hoping it works out” or relying on generic financial advice has only left you more stressed, confused, and uncertain — while the clock keeps ticking and your savings don’t feel like enough.

Instead, what you need is a clear, easy-to-follow system built for people just like you — who might be starting late, feeling behind, and worried they’ve run out of options.

One that doesn’t require risky investments or complex strategies — just proven steps to rescue your retirement and give you back control.

That’s exactly what the Retirement Rescue Plan delivers — a strategic, research-backed approach to help you build lasting income and security, even if you’re behind on savings.

And the best part?

It’s been designed for real people — not financial experts.

So you can finally stop guessing, stop stressing, and start moving toward the peace of mind you deserve.

HERE’S WHAT YOU’LL GET INSIDE

The Proven 12-Tactic Framework to Rescue Your Retirement, Catch Up on Savings, and Sleep Easy

This isn’t a quick fix or fluffy advice. It’s a practical, research-backed system that tackles every part of your financial stress head-on. With real numbers, real examples, and a clear roadmap, this guide helps you take back control — starting right where you are.

Face the Fear & Reclaim Control

Uncover why 67% of pre-retirees fear outliving their money — and use proven mindset shifts to move from anxiety to confidence.

➡️ Includes retirement anxiety tools + mindset reframe workbook.

The 12 Tactics to Catch Up — Fast

From maximizing catch-up contributions to eliminating high-interest debt and using guaranteed income tools, you’ll learn exactly how to start closing your savings gap — even if you feel way behind.

➡️ Includes real-life examples, savings calculators, and a 30-day action plan.

Build Your Bulletproof Retirement Plan

Get step-by-step guidance on estimating your expenses, calculating your gap, handling healthcare costs, minimizing taxes, and creating peace of mind for the next 30 years.

➡️ Includes worksheets, calculators, and checklists to make it easy.

Experience the relief of finally having a plan — and take control of your retirement starting today.

WHY WE’RE DIFFERENT

Get The 55+ Financial Fix Today & Finally Feel Secure About Retirement

Before / Old Way

Hoping Social Security alone will be enough — but unsure how much you’ll actually get

Feeling overwhelmed by rising healthcare costs and inflation with no plan in place

Avoiding financial conversations because you feel behind and ashamed

Letting fear of making a wrong move keep you stuck in inaction

Losing sleep worrying you’ll run out of money or become a burden to your family

After / New Way

Know exactly how much you need — and how to start closing the gap starting today

Build a healthcare and long-term care strategy so medical bills don’t drain your savings

Follow a clear, jargon-free plan that fits your lifestyle, goals, and timeline

Implement 12 proven tactics to boost savings, reduce risk, and secure income streams

Gain the confidence that comes from having a real plan you can trust — even if you're starting late

INTRODUCING THE ONLY RETIREMENT CATCH-UP SYSTEM YOU NEED

Get The 55+ Financial Fix and Take Control of Your Retirement — Even If You’re Starting Late

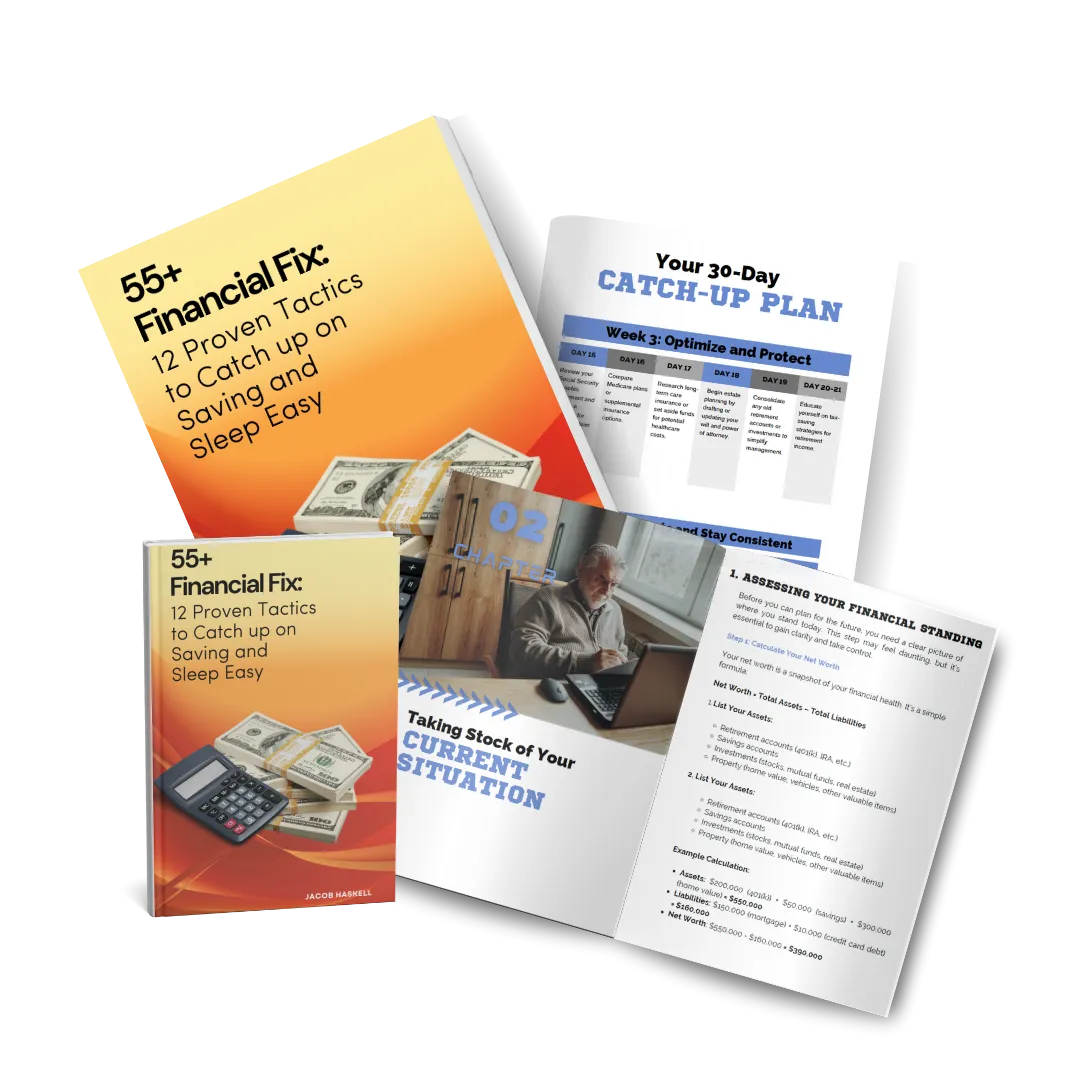

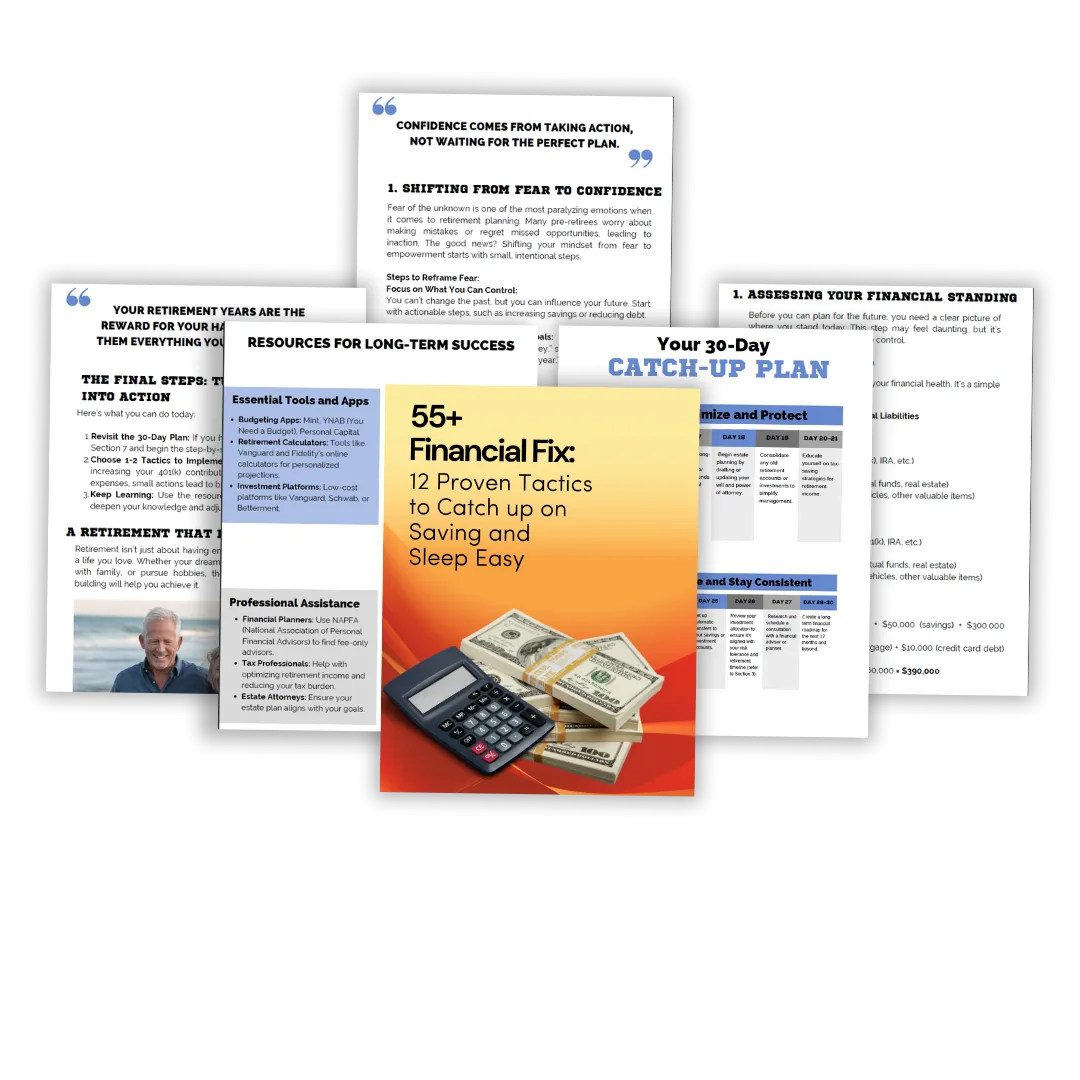

The 55+ Financial Fix

The proven step-by-step retirement rescue system for pre-retirees who feel behind, overwhelmed, or out of time

“This gave me the clarity I’ve been missing for years.”

“I had no idea how far off track I was until I worked through this guide. For the first time, I understand my retirement gap and have a step-by-step plan to close it. I only wish I found it sooner.” - Carlos M., 58

What's included:

Facing Your Fears & Reframing Retirement

- Break free from anxiety, regret, and analysis paralysis with clear mindset shifts, powerful reframes, and confidence-building exercises.

12 Proven Tactics to Catch Up on Savings

- Learn step-by-step strategies to boost your retirement savings, optimize your investments, eliminate costly debt, and reduce expenses — even if you’re behind.

Healthcare & Long-Term Care Planning

- Get the facts (and the plan) to handle the $315,000+ healthcare burden retirees face — without draining your savings.

Create Predictable Income in Retirement

- Explore income strategies including Social Security optimization, annuities, and smart investment tools to generate reliable income you can count on.

The 30-Day Catch-Up Plan

- A done-for-you action calendar with simple daily steps to assess your finances, increase your savings, and build lasting momentum.

Normally: $97

Today: $27

14 Day No-Questions Money Back Guarantee

TESTIMONIALS

What Others Are Saying About The 55+ Financial Fix

"I finally feel like I have a plan."

"Before this, I felt so lost about retirement. I didn’t think I had enough time to catch up. But this guide showed me exactly what to do, and in just a few weeks, I already feel more in control of my future."

– Brenda R., 58

"It helped me grow my savings by $12,000 in under 6 months."

"I followed the catch-up contributions and spending realignment tips and was shocked at how much I could save. I even showed it to my husband, and now we’re using the plan together."

– Marcus T., 61

"I’ve stopped losing sleep over retirement."

"This is the first time I’ve read a financial guide that didn’t make me feel dumb or behind. I actually understood it — and that made all the difference."

– Sheila P., 54

"From overwhelmed to empowered."

"I always avoided thinking about retirement because it felt too late. But this broke it down into steps I could take now — and for the first time, I believe I can retire without fear."

– Anthony G., 56

TRY IT OUT RISK FREE

Backed by a 14-Day Fair-Use Money Back Guarantee

We’re confident that once you go through

The 55+ Financial Fix, you’ll feel more in control, more hopeful, and finally equipped with a real plan for retirement — even if you’re starting late.

But if you’ve given the material a genuine try and still don’t feel it’s the right fit, just reach out within 14 days. We’ll review your request and issue a refund if it aligns with our fair-use policy — no hard feelings.

How it works

• Email us at [email protected] with the subject line: “Refund Request”

• Include your name, email, and proof of purchase

• Let us know how you applied the material and why it didn’t work for you

We’ll get back to you quickly, and if it qualifies, we’ll process your refund.

MEET JACOB

You Deserve a Retirement You Can Feel Good About — I’m Here to Help You Get There

Who’s behind The 55+ Financial Fix — and why should I listen?

For over a decade, I’ve helped thousands of pre-retirees get back on track with their savings — no matter how far behind they felt. I created this system for the people who thought they were out of time, out of options, or just overwhelmed by what retirement planning is supposed to look like.

Too many smart, hardworking adults over 50 feel stuck…

Ashamed they haven’t saved enough.

Worried they’ll become a burden.

Scared of working forever.

I built The 55+ Financial Fix to change that — to give people a

simple, realistic roadmap to secure their future without risky investments, complicated spreadsheets, or having to “become a finance person.”

Here’s what this framework has already helped people do:

Catch up on tens of thousands in savings — even starting at age 55 or older

Create new income strategies that generate $1,500–$3,000/month without market risk

Create new income strategies that generate $1,500–$3,000/month without market risk

Now, I want to help you get the same clarity and confidence — with a plan that actually works for your life.

ACT NOW TO SECURE THE DISCOUNT

Time is of The Essence, Act Now Before It’s Too Late

We’re currently doing a special deal, but it’s ending soon so join now before prices go up from $27 to $97. Just ask for a refund later if you’re not 100% happy.

STILL NOT SURE IF THIS IS FOR YOU?

Frequently Asked Questions

Who’s this perfect for?

The 55+ Financial Fix is designed for pre-retirees (ages 50+) who feel behind on savings, unsure where to start, or overwhelmed by conflicting advice.

It’s especially helpful if you:

• Have less than $250k saved

• Feel like time is running out

• Worry about outliving your money

• Want a real plan that doesn’t require becoming a financial expert

If that sounds like you — this was made for you.

What exactly do I get when I buy this?

You’ll receive instant access to the full 55+ Financial Fix digital guide, including:

• 12 proven savings and income-building tactics

• Real-life examples and easy-to-follow explanations

• A 30-day action plan Tools, checklists, and worksheets to help you apply everything

• A framework that gives you peace of mind — not more financial confusion

Everything is digital and delivered instantly to your inbox.

What if I get stuck and need extra support?

We’ve designed this guide to be completely beginner-friendly — no jargon, no overwhelm. But if you hit a snag, you can reach out to our support team at [email protected], and we’ll help clarify anything you need.

Is there a satisfaction guarantee?

Yes — every purchase is backed by our 14-Day Fair-Use Refund Policy. If you’ve gone through the material and can show it didn’t deliver value for your situation, we’ll issue a refund — no hard feelings.

We just ask that you give it a real try first. That’s how confident we are in what’s inside.

Copyrights 2025 | Retirement Shield™ | Terms & Conditions